Jan

Rupicard Credit Card

Apply Now

INTRODUCTION

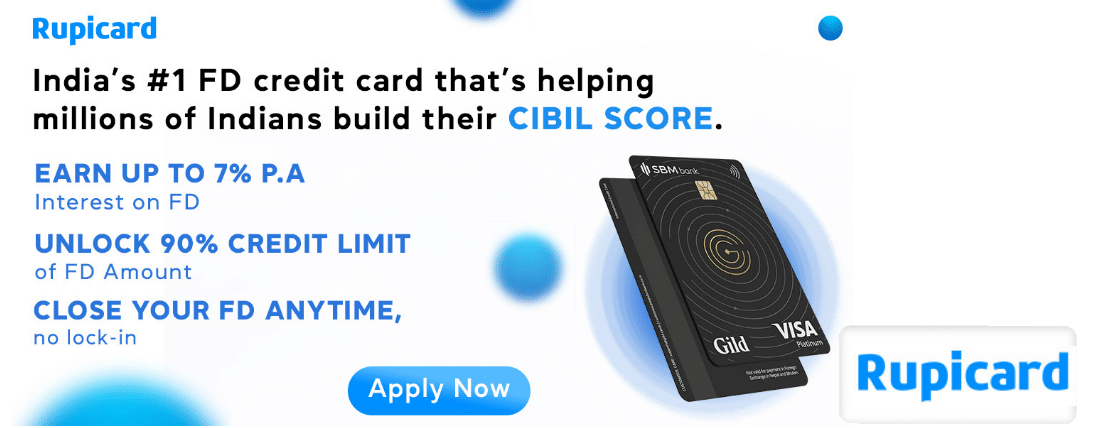

Enter the realm of credit-building excellence with Rupicard, India's leading FD credit card, dedicated to assisting countless individuals in elevating their CIBIL scores. As the go-to solution for many Indians, Rupicard stands out as a reliable financial tool designed to facilitate the improvement of your creditworthiness. With a focus on accessibility and simplicity, Rupicard has become the preferred choice for millions, making the journey to a stronger CIBIL score a seamless and rewarding experience. Embrace financial empowerment with Rupicard, your trusted companion on the path to a brighter credit future.

Key Features and Benefits of Rupicard:

Credit Score Improvement:

Boost your credit score effectively by ensuring timely payments of your credit card bills. Rupicard provides a practical and straightforward way to enhance your creditworthiness.

Flexible Credit Limit Options:

Tailor your credit experience by deciding your own credit limit. Begin with a minimum Fixed Deposit (FD) of Rs 5,000 and have the flexibility to top up your FD, allowing you to increase your credit limit according to your financial needs.

Generous 45-Day Interest-Free Credit Period:

Enjoy a substantial 45-day interest-free credit period with Rupicard. This extended grace period provides ample time to manage your expenses and pay your bills without incurring interest charges.

Freedom to Choose Your Credit Limit:

With Rupicard, you have the freedom to decide your credit limit based on your financial capacity and requirements. This personalized approach empowers you to have greater control over your credit utilization.

Easy and Convenient Bill Payments:

Simplify your financial routine by paying your bills conveniently at the end of the interest-free credit period. This streamlined process ensures that you make payments without the burden of interest charges.

Instant Cash Withdrawal:

Rupicard offers the convenience of instant cash withdrawal, allowing you to access up to 90% of your credit limit from ATMs nearby. This feature becomes particularly valuable during emergency situations, providing a reliable financial fallback.

Secure and Accessible:

Rest easy knowing that Rupicard prioritizes security in every transaction. The card is not only a convenient financial tool but also a secure one, ensuring that your transactions are protected.

Transparent and No-Fee Structure:

Rupicard maintains a transparent fee structure, making it easier for users to understand and manage their credit card expenses. With no hidden fees, users can confidently utilize the card without unwelcome surprises.

Smart Financial Management:

Rupicard promotes smart financial management by encouraging responsible credit usage. By providing the tools to control your credit limit and offering interest-free periods, Rupicard empowers users to make informed financial decisions.

FD-Backed Security:

The credit limit is backed by a Fixed Deposit, adding an extra layer of security to your credit usage. This innovative feature ensures responsible credit behavior while leveraging your FD for a secured credit experience.

Eligibility Criteria for Rupicard:

Age Requirement:

Applicants should typically fall within a specified age range, commonly between 18 to 65 years. The exact age criteria may vary, and individuals outside this range may not be eligible.

Residency Status:

Rupicard is generally available to both resident Indians and non-resident Indians (NRIs). However, specific eligibility conditions may apply based on residency status.

Fixed Deposit (FD) Requirement:

Eligibility for Rupicard is often linked to the creation of a Fixed Deposit (FD) with a minimum amount, such as Rs 5,000. Applicants may need to open and maintain an FD as security for the credit limit.

Credit Score:

A good credit score is typically preferred for Rupicard eligibility. The specific score requirement may vary, and applicants with a higher credit score may have a better chance of approval.

Income Criteria:

While Rupicard is linked to an FD, there may be income criteria, especially for top-up credit limit options. Applicants may need to meet specific income requirements, and details can be obtained from Rupicard.

Documents Needed for Rupicard:

Proof of Identity:

Aadhaar Card

Passport

Voter ID

PAN Card

Proof of Address:

Utility bills (electricity, water, gas)

Aadhaar Card

Passport

Rent Agreement (if applicable)

Photographs:

Passport-sized photographs of the applicant.

Fixed Deposit Details:

Documentation related to the creation and maintenance of the Fixed Deposit, including FD certificate or statement.

Income Proof:

Income proof may be required, especially for top-up credit limit options. Salaried individuals may need to provide salary slips, while self-employed individuals may need to submit income tax returns or other relevant documents.

Bank Statements:

Latest bank statements for the last 3 to 6 months.

Employment Proof:

For salaried individuals, a letter from the employer or an employment certificate may be required.

Credit Score Report:

A copy of the credit report may be requested to assess creditworthiness.

Application Form:

Complete and duly signed credit card application form provided by Rupicard.

Additional Documents:

Depending on specific requirements, Rupicard may request additional documents to process the credit card application.

Why Choose Fayda App for Rupicard:

Seamless Integration:

Fayda App seamlessly integrates with Rupicard, providing users with a unified platform to manage their credit card transactions, rewards, and financial activities in one place.

Blockchain-Based Loyalty Program:

Fayda App offers a cutting-edge blockchain-based loyalty program that aligns perfectly with Rupicard's innovative approach. Users can benefit from transparent, secure, and tamper-proof reward transactions.

Crypto Rewards Synergy:

Rupicard users can maximize their rewards by leveraging Fayda App's cryptocurrency rewards. This synergy allows users to enjoy the traditional benefits of a credit card along with the modern advantages of cryptocurrencies.

Referral Opportunities:

Fayda App's referral program complements the Rupicard experience, providing users with additional avenues to earn rewards. Referring others to the app can result in enhanced benefits for both the referrer and the new user.

Financial Services Integration:

Fayda App extends beyond a loyalty program, offering integrated financial services. Users can access various financial products and services directly through the app, creating a comprehensive and user-centric financial ecosystem.

Cashback on Financial Transactions:

Rupicard users can enjoy cashback benefits on various financial transactions through Fayda App. This additional perk enhances the overall value proposition for users, providing tangible benefits for their financial activities.

User-Friendly Mobile Experience:

Fayda App ensures a user-friendly mobile interface, making it convenient for Rupicard users to manage their credit card transactions, rewards, and financial services all in one place.

Network Building and Benefits:

Fayda App's network-building features complement the community aspect of Rupicard. Users can expand their network, enjoy referral benefits, and participate in a shared ecosystem that amplifies the overall benefits.

Innovation and Digital Integration:

Both Fayda App and Rupicard represent a commitment to innovation and digital integration. Users benefit from cutting-edge solutions that simplify and enhance their financial experiences.

Transparent Redemption Process:

Fayda App ensures a transparent redemption process for converting earned rewards into tangible value. Users can easily understand and access the benefits they accrue through their Rupicard transactions.

FAQ

1. What is Fayda App, and how does it complement Rupicard?

Fayda App is a blockchain-based loyalty program that seamlessly integrates with Rupicard. It enhances the credit card experience by providing users with a transparent and secure platform for managing transactions, earning rewards, and accessing financial services.

2. How can I link my Rupicard to Fayda App?

The process of linking your Rupicard to Fayda App is typically outlined in the app itself. Follow the provided instructions within the app or contact customer support for assistance.

3. What benefits does Fayda App offer for Rupicard users?

Fayda App offers a blockchain-based loyalty program, cryptocurrency rewards, referral opportunities, and integrated financial services with cashback benefits for Rupicard users. It enhances the overall value proposition of using Rupicard.

4. Can I earn rewards using Rupicard transactions on Fayda App?

Yes, Fayda App rewards Rupicard users with cryptocurrency and other benefits for transactions made through the app. This includes 2x assured cashbacks for scan and pay transactions.

5. Is there a cost associated with using Fayda App for Rupicard transactions?

Fayda App itself is typically free to use. However, users should check for any specific terms or conditions related to additional services or features within the app.

6. How does the blockchain-based loyalty program work on Fayda App?

Fayda App's loyalty program operates on the blockchain, ensuring transparent and secure reward transactions. Users earn crypto coins for various activities, enhancing the overall value of their Rupicard experience.

7. Can I redeem the rewards earned on Fayda App for tangible benefits with Rupicard?

Yes, Fayda App often provides options for users to redeem their earned rewards. The redemption process may vary, but users can typically convert their rewards into tangible value, such as cashback or other benefits.

8. Is my financial information secure when using Fayda App with Rupicard?

Both Fayda App and Rupicard prioritize the security of user information. Transactions and data are typically encrypted to ensure a secure and safe user experience.

9. How do I participate in Fayda App's referral program with Rupicard?

Details on participating in Fayda App's referral program are usually available within the app. Users can refer others to Fayda App, and when their referrals use Rupicard or other services, they can earn additional rewards.

10. Can I access all Rupicard transactions through Fayda App?

- Fayda App typically provides a platform to manage and view transactions made using Rupicard. Users can conveniently monitor their card activities, rewards, and other associated benefits within the app.