Apr

How can I take loan from KreditBee?

What is KreditBee?

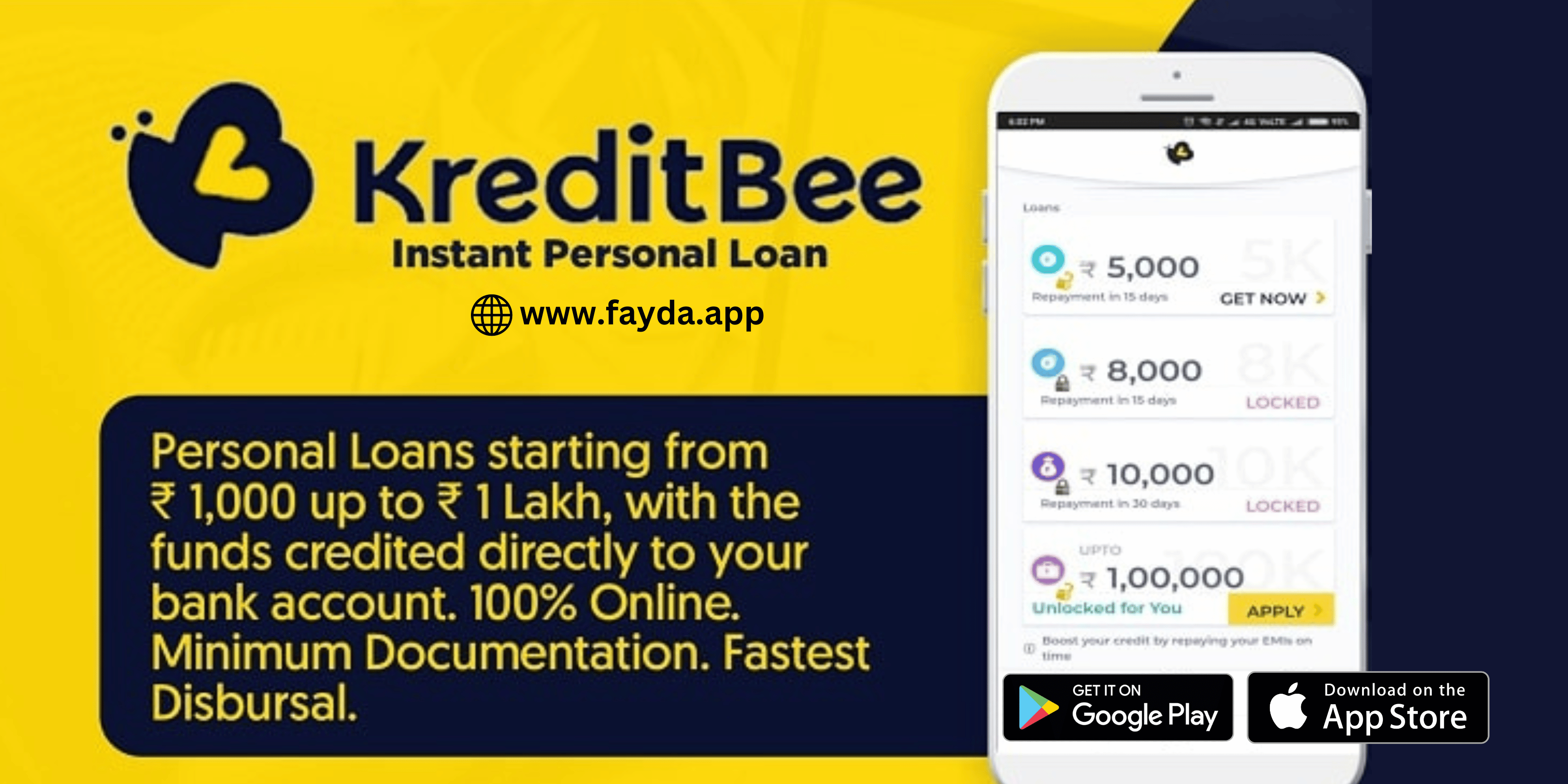

KreditBee is an online lending platform in India that offers quick and hassle-free loans to individuals. They provide various types of loans, such as personal loans, salary advances, and credit lines, to help borrowers meet their financial needs. KreditBee has a simple and user-friendly online application process, and loan approval and disbursement are typically fast. They require minimal documentation and offer flexible repayment options. KreditBee aims to provide accessible and convenient financial solutions to individuals in need of short-term credit.

Why should i choose KreditBee to take loan?

There are several reasons why you may choose KreditBee as your preferred online lending platform to take a loan:

- Quick and Hassle-Free Process: KreditBee offers a simple and user-friendly online application process that allows you to apply for a loan from the comfort of your home or office. The application process is quick, and loan approval and disbursement are typically fast, allowing you to access funds when you need them the most.

- Flexible Loan Options: KreditBee offers various types of loans, such as personal loans, salary advances, and credit lines, to cater to different financial needs. You can choose the loan type and amount that best suits your requirements, making it a flexible option for borrowing.

- Minimal Documentation: KreditBee requires minimal documentation compared to traditional banks, making the loan application process hassle-free and convenient. You can upload the necessary documents online, eliminating the need for physical paperwork.

- No Collateral Required: KreditBee offers unsecured loans, which means you do not need to provide any collateral or security to avail a loan. This makes it accessible to a wider range of individuals who may not have assets to pledge as collateral.

- Customized Loan Terms: KreditBee offers personalized loan terms based on your creditworthiness and repayment history. This means that you can get loan terms that are tailored to your financial situation, making it more convenient for you to repay the loan.

- Transparent and Fair Practices: KreditBee follows transparent and fair lending practices, with no hidden charges or fees. The loan terms and conditions are clearly communicated to borrowers, ensuring transparency in the borrowing process.

- Good Customer Support: KreditBee has a dedicated customer support team that is available through their website, app, or helpline to assist borrowers with any queries or concerns they may have.

- Credit Building Opportunities: KreditBee reports loan repayment data to credit bureaus, which can help you build or improve your credit score. Timely repayment of your KreditBee loan can positively impact your credit history and increase your creditworthiness for future borrowing needs.

In conclusion, KreditBee offers a convenient, transparent, and flexible lending platform for individuals in need of short-term credit. With their quick loan approval process, minimal documentation requirements, personalized loan terms, and good customer support, KreditBee can be a suitable option for those seeking loans in India. However, it's important to carefully review the loan terms and conditions, assess your repayment ability, and make an informed decision before borrowing from any lending platform.

Step-by-Step Guide: How to Take a Loan from KreditBee

Introduction:

In today's fast-paced world, online lending platforms have become increasingly popular due to their convenience and accessibility. KreditBee, a leading online lending platform in India, offers quick and hassle-free loans to individuals in need of financial assistance. Whether you need a personal loan, salary advance, or credit line, KreditBee can be a viable option. In this blog, we will provide you with a step-by-step guide on how to take a loan from KreditBee.

Step 1: Download Fayda App

The first step to open a Kotak 0 balance savings account online is to download Fayda App from the respective app store on your smartphone.

Step 2: Register an Account with KreditBee

Next, you will need to register an account with KreditBee. You can sign up by providing the required information, such as your name, mobile number, email address, and any other details as requested. It's important to provide accurate and up-to-date information during the registration process.

Step 3: Complete the KYC (Know Your Customer) Process

As per the regulations in India, KreditBee requires customers to complete the KYC (Know Your Customer) process to verify their identity. You will need to submit the required documents, such as your Aadhaar card, PAN card, bank account details, and other relevant information. You can upload the documents through the KreditBee app or website.

Step 4: Choose the Type of Loan and Loan Amount

Once your account is verified, you can choose the type of loan you want to apply for. KreditBee offers different types of loans, such as personal loans, salary advances, and credit lines. You can select the loan amount and repayment tenure that suits your needs.

Step 5: Provide the Necessary Details

Next, you will need to provide the necessary details to complete your loan application. This may include your employment information, income details, and any other information as requested by KreditBee. It's important to provide accurate and verifiable information to increase the chances of loan approval.

Step 6: Review the Loan Terms and Conditions

Before submitting your loan application, it's crucial to review the loan terms and conditions carefully. This includes the interest rate, processing fees, and repayment schedule. Make sure you understand the loan terms and are comfortable with the repayment obligations.

Step 7: Submit Your Loan Application

Once you have reviewed and confirmed all the details, you can submit your loan application through the KreditBee app or website. KreditBee will evaluate your loan application based on their internal criteria and may request additional documents or information if needed.

Step 8: Loan Approval and Disbursement

If your loan application is approved, you will receive a loan offer from KreditBee. Carefully review the loan offer, including the loan amount, interest rate, fees, and repayment schedule. If you are satisfied with the loan offer, you can accept it and provide your consent. The loan amount will be disbursed directly to your bank account or in your KreditBee wallet, as per the terms and conditions.

Step 9: Repay Your Loan

Once you have received the loan amount, it's important to repay your loan as per the agreed-upon repayment schedule. KreditBee offers various repayment options, such as EMI (Equated Monthly Installments) or one-time payment, which you can choose based on your convenience. Make sure to repay your loan on time to avoid any late payment charges or penalties and to maintain a good credit history.

Step 10: Contact KreditBee Customer Support

If you have any questions, concerns, or issues regarding your loan from KreditBee, you can always contact their customer support. KreditBee provides customer support through their website, app, or helpline, and their team will be happy to assist you with any queries you may have.

Conclusion:

Taking a loan from KreditBee can be a convenient and straightforward process. By following the step-by-step guide mentioned above, you can apply for a loan from KreditBee with ease. Remember to provide accurate information during the registration and loan application process, review the loan terms and conditions carefully, and repay your loan on time to maintain a good credit history. If you have any questions or concerns, do not hesitate to contact KreditBee's customer support for assistance. Get the financial assistance you need with KreditBee's online lending platform and manage your loan efficiently.