Jan

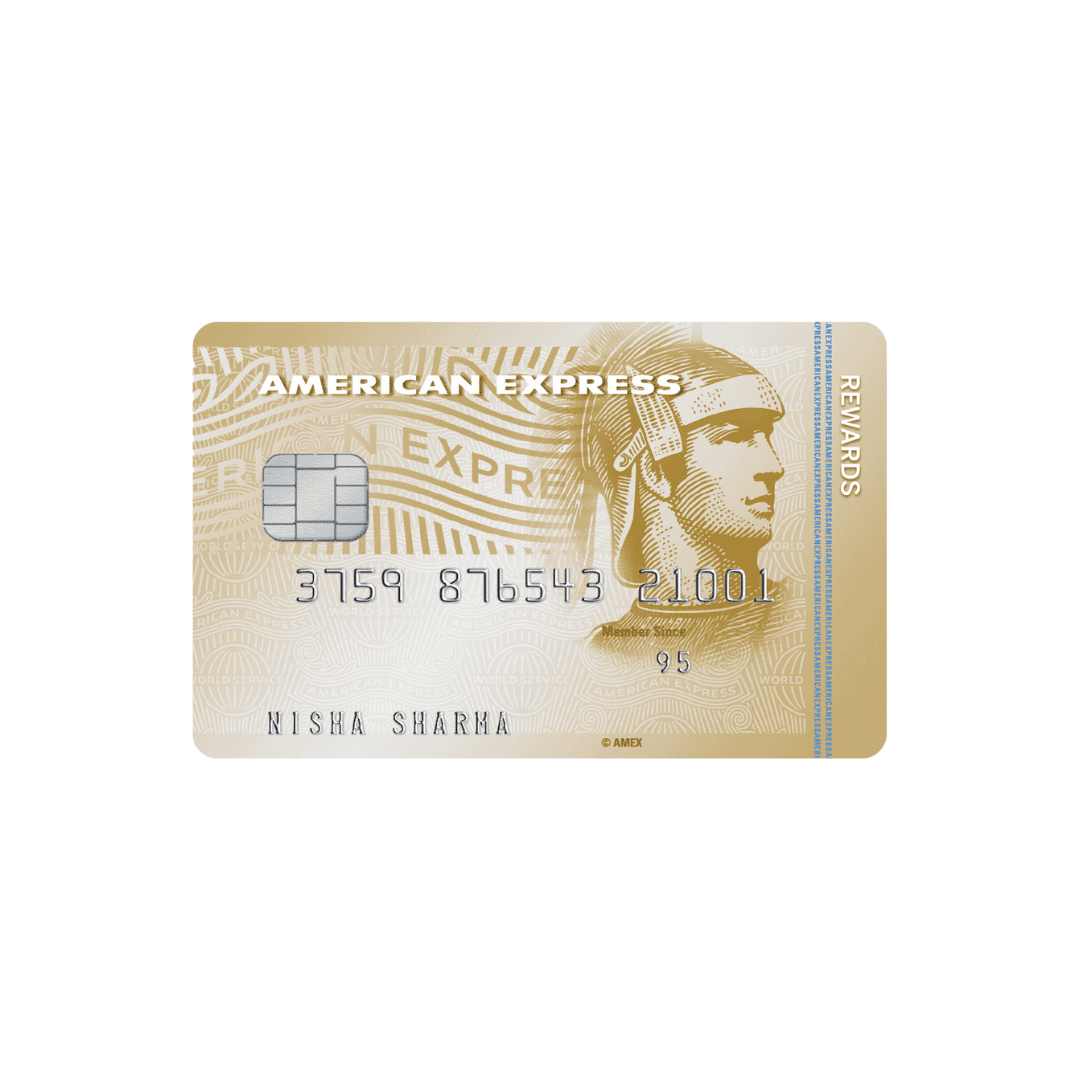

AMERICAN EXPRESS MEMBERSHIP CARD

Apply Now

Introduction

The American Express Membership Card stands out as a rewarding choice, allowing you to accumulate valuable points for each purchase. These accrued points can be exchanged for gift vouchers from leading brands such as Amazon and Flipkart. While the card has an annual fee of Rs. 4,500, it provides extra rewards when you achieve specific monthly spending goals. This credit card ensures you earn and relish rewards for your routine expenditures.

ADVANTAGES OF AMERICAN EXPRESS MEMBERSHIP CARD:

EARNINGS ON PURCHASES:

Cardholders accumulate reward points with every card transaction, presenting an opportunity to earn rewards that can be redeemed for various options, including gift vouchers, travel bookings, and merchandise.

REDEEMABLE GIFT VOUCHERS:

Accrued reward points can be exchanged for gift vouchers from renowned brands like Amazon and Flipkart, offering users the flexibility to choose their preferred rewards.

BONUS REWARDS FOR MONTHLY ACHIEVEMENTS:

The card provides extra rewards when users meet specific spending milestones within a billing cycle, enhancing the overall value of their expenditures.

VERSATILE REDEMPTION CHOICES:

In addition to gift vouchers, reward points offer versatile redemption options, such as travel bookings, hotel stays, and airline miles, allowing cardholders to tailor their rewards to their preferences.

COMPLIMENTARY SUPPLEMENTARY CARD:

Cardholders can obtain a complimentary supplementary card for family members, extending the benefits of the credit card to their loved ones.

ZERO LOST CARD LIABILITY:

American Express ensures zero liability for cardholders in the event of unauthorized transactions on a lost or stolen card, guaranteeing their security.

AMERICAN EXPRESS MEMBERSHIP CARD ELIGIBILITY REQUIREMENTS:

INDIAN RESIDENCY AND BANK ACCOUNT:

Applicants must be Indian residents and possess a savings or current account in an Indian or multinational bank.

CREDIT HISTORY:

A good credit score with no history of payment defaults is essential for eligibility.

AGE CRITERIA:

Applicants should be at least 18 years old to qualify for the American Express Membership Card.

OCCUPATION:

Both salaried and self-employed individuals are eligible to apply for the card.

MINIMUM INCOME:

Applicants must meet the minimum income requirement of Rs. 6 lakh per annum to be eligible for the card.

SERVICEABLE CITIES:

The American Express Membership Card is available to individuals residing in specific cities, including Delhi/NCR, Mumbai, Chennai, Hyderabad, Bangalore, Pune, Nagpur, Nasik, Trivandrum, Indore, Jaipur, Ahmedabad, Chandigarh, Coimbatore, Mysuru, and Surat.

How to open an American Express Membership Card on the Fayda App

1. Install Fayda App From Playstore (use the link below)

https://play.google.com/store/apps/details?id=my.fayda.app&referrer=FY166506

2. Go to the Bank account category from offers or side bar and look for or search American Express Membership Card

3. Enter a few details like full name, email, number, PAN and click on the button to proceed

4. Fill in all the required details asked by American Express to open American Express Membership Card

5. Follow the instructions given by American Express and go your video KYC if required

6. After the successful submission of your application to open an American Express Membership Card wait for few time to get your account activated.

Refer the video help guide here (link)

Why choose Fayda To open an American Express Membership Card

1. Cashback up to Rs.1000/- on opening American Express Membership Card

2. Crypto coin rewards on every service availed

3. Referral income of up to Rs.500/-

WHY CHOOSE FAYDA APP FOR THE AMERICAN EXPRESS MEMBERSHIP CARD:

SEAMLESS APPLICATION PROCESS:

Fayda App offers a hassle-free and straightforward application process for the American Express Membership Card, ensuring a quick and convenient experience.

EXCLUSIVE OFFERS AND PROMOTIONS:

By choosing Fayda App for your American Express Membership Card application, you gain access to exclusive offers and promotions that can enhance your overall cardholder experience.

PERSONALIZED ASSISTANCE:

Fayda App provides personalized assistance throughout the application process, addressing any queries or concerns you may have and ensuring a smooth experience.

TIME-EFFICIENT APPROVAL:

Fayda App streamlines the approval process, ensuring that your American Express Membership Card application is processed efficiently, saving you time and effort.

ADDITIONAL BENEFITS:

Fayda App may offer additional benefits or rewards for choosing their platform for your American Express Membership Card application, adding extra value to your credit card experience.

FAQ

1. What is the American Express Membership Card?

The American Express Membership Card is a credit card that offers rewards for your transactions. You earn reward points for every purchase, which can be redeemed for various benefits, including gift vouchers.

2. How can I earn reward points with the American Express Membership Card?You earn reward points with every transaction made using the card. The more you spend, the more points you accumulate. These points can be redeemed for gift vouchers, travel bookings, and other exciting options.

3. What are the additional rewards for reaching monthly spending milestones?

The card provides extra rewards when you reach specific spending milestones during a billing cycle. This offers you additional value for your spending and enhances your overall reward benefits.

4. Can I get a supplementary card for my family members?

Yes, you can get a complimentary supplementary card for your family members. This allows them to enjoy the benefits of the credit card and share in the rewards.

5. What options do I have for redeeming reward points?

You have flexible redemption options, including gift vouchers, travel bookings, hotel stays, and more. This gives you the freedom to choose rewards that suit your preferences.

6. Is there any liability for unauthorized transactions on a lost or stolen card?

American Express provides zero lost card liability. In case of any unauthorized transactions on a lost or stolen card, you are protected, and you won't be held liable.

7. What are the eligibility criteria for the American Express Membership Card?

To be eligible, you need Indian residency, a good credit score with no payment defaults, a minimum age of 18 years, and either a salaried or self-employed occupation. The minimum income requirement is Rs. 6 Lakh per annum.

8. In which cities is the American Express Membership Card serviceable?

The card is serviceable in cities like Delhi/NCR, Mumbai, Chennai, Hyderabad, Bangalore, Pune, Nagpur, Nasik, Trivandrum, Indore, Jaipur, Ahmedabad, Chandigarh, Coimbatore, Mysuru, and Surat.

9. Why choose Fayda App for the American Express Membership Card?

Fayda App provides a convenient platform for credit card applications, ensuring a seamless and user-friendly experience for users.

10. How can I apply for the American Express Membership Card through Fayda App?

You can apply for the American Express Membership Card through Fayda App by following the simple application process provided on the platform.